Constrained Liquidity: Most of the alternative assets that could be held in an SDIRA, like property, non-public equity, or precious metals, is probably not quickly liquidated. This can be a difficulty if you must access cash swiftly.

However there are several Advantages linked to an SDIRA, it’s not without its personal disadvantages. Many of the frequent reasons why buyers don’t select SDIRAs include:

Larger Costs: SDIRAs usually include greater administrative expenses in comparison with other IRAs, as specified areas of the administrative method cannot be automatic.

Ahead of opening an SDIRA, it’s important to weigh the opportunity advantages and disadvantages dependant on your distinct monetary plans and threat tolerance.

This includes knowing IRS restrictions, managing investments, and steering clear of prohibited transactions which could disqualify your IRA. A scarcity of knowledge could bring about highly-priced problems.

Research: It is referred to as "self-directed" for any purpose. Having an SDIRA, you are totally liable for completely studying and vetting investments.

A self-directed IRA is an amazingly effective investment automobile, but it surely’s not for everyone. Since the saying goes: with fantastic electrical power arrives great accountability; and having an SDIRA, that couldn’t be a lot more legitimate. Keep reading to discover why an SDIRA might, or might not, be in your case.

Be answerable for how you grow your retirement portfolio by using your specialised expertise and interests to take a position in assets that fit with all your values. Acquired expertise in real estate property or non-public equity? Utilize it to support your retirement planning.

Building one of the most of tax-advantaged accounts allows you to hold more of the money you invest and receive. Dependant upon whether or not you decide on a standard self-directed IRA or a self-directed Roth IRA, you've got the probable see it here for tax-free or tax-deferred development, offered selected disorders are achieved.

When you finally’ve uncovered an SDIRA service provider and opened your account, you may well be asking yourself how to actually get started investing. Knowing both of those the rules that govern SDIRAs, and also how to fund your account, can assist to put the muse for a future of profitable investing.

Should you’re seeking a ‘set and neglect’ go to this website investing tactic, an SDIRA likely isn’t the proper alternative. Since you are in overall Management about just about every investment produced, It truly is your decision to perform your own due diligence. Remember, SDIRA custodians are usually not fiduciaries and cannot make tips about investments.

Unlike stocks and bonds, alternative assets will often be more difficult to provide or can include demanding contracts and schedules.

Adding money directly to your account. Bear in mind contributions are subject matter to once-a-year IRA contribution boundaries set through the IRS.

SDIRAs are often used by fingers-on buyers who're prepared to take on the risks and tasks of selecting and vetting their investments. Self directed IRA accounts will also be great for buyers that have specialized information in a distinct segment industry that they would like to spend money on.

No, You can not put money into your own personal business enterprise having a self-directed IRA. The IRS prohibits any transactions amongst your IRA plus your personal organization simply because you, given that the operator, are considered a disqualified individual.

Ease of Use and Engineering: A consumer-pleasant platform with on the web helpful resources instruments to trace your investments, submit paperwork, and deal with your account is important.

Greater investment choices signifies you could diversify your portfolio further than shares, bonds, and mutual resources and hedge your portfolio in opposition to market fluctuations and volatility.

A lot of traders are amazed to master that applying retirement resources to speculate in alternative assets has long been possible because 1974. Nonetheless, most brokerage firms and banking institutions concentrate on providing publicly traded securities, like stocks and bonds, because they deficiency the infrastructure and abilities to control privately held assets, including property or non-public equity.

Criminals at times prey on SDIRA holders; encouraging them to open up accounts for the objective of producing fraudulent investments. They frequently idiot investors by telling them that Should the investment is approved by a self-directed IRA custodian, it should be legitimate, which isn’t genuine. Once more, You should definitely do comprehensive due diligence on all investments you select.

Patrick Renna Then & Now!

Patrick Renna Then & Now! Ashley Johnson Then & Now!

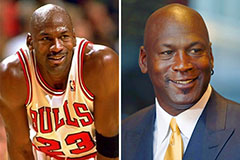

Ashley Johnson Then & Now! Michael Jordan Then & Now!

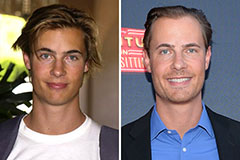

Michael Jordan Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!